The Sandwich generation refers to a generation of people who are simultaneously caring for their aging parents and their children. This group often feels “sandwiched” between the needs of their parents and their children and may face challenges in balancing caregiving responsibilities, financial obligations, and personal well-being. Effective estate planning for the sandwich generation is critical in managing these dual responsibilities.

The Importance of Estate Planning for the Sandwich Generation

Estate planning is essential when you are responsible for caring for your children and your adult parents. Proper planning provides a structured approach to managing the complexities of caring for children and elderly parents. This planning can offer peace of mind and a clear path forward in challenging circumstances.

A. Protecting Minor Children: Estate planning allows parents to designate guardians for their minor children in the event of their death or incapacity, ensuring their care and upbringing are delegated to the right people.

B. Managing Assets: The Sandwich generation often juggles financial responsibilities for their children and aging parents. Estate planning helps ensure that assets are managed and distributed according to their wishes, providing financial security for their loved ones.

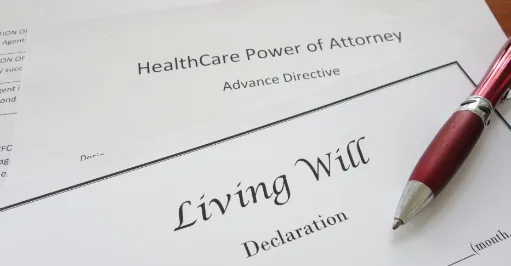

C. Planning for Long-Term Care: With aging parents, estate planning can help navigate issues related to their long-term care, including establishing powers of attorney and healthcare directives to ensure their wishes are honored.

D. Minimizing Tax Burden: Proper estate planning can help minimize the tax burden on the estate, allowing more assets to be passed on to the next generation.

E. Avoiding Family Conflict: Clear estate planning can help minimize conflicts among family members by clearly outlining the distribution of assets and addressing potential disputes.

Strategies for Effective Estate Planning

- Prioritizing and Reprioritizing Responsibilities

- Estate planning for the sandwich generation starts with effectively managing daily tasks. Identifying urgent versus non-urgent tasks can help balance the care of children and elderly parents.

- Self-Care as a Crucial Aspect of Estate Planning

- Self-care is vital to avoid caregiver burnout. Individuals in the sandwich generation need to maintain their well-being to provide the best care for their loved ones.

- Understanding Legal Rights and Workplace Benefits

- Knowing workplace rights, such as those provided by the Family Medical Leave Act (FMLA), is an integral part of estate planning for the sandwich generation. This knowledge can help caregivers maintain job security while caring for their families.

- Communication and Support Networks

- Open communication within the family and access to support networks and forums are key to managing the expectations and responsibilities of being part of the sandwich generation.

- Financial Planning and Resource Management

- A crucial aspect of estate planning for the sandwich generation is evaluating financial resources. This includes understanding the financial capabilities of aging parents and exploring public assistance or family contributions when needed.

- Discussions with Aging Parents and Family Members

- Conversations about care preferences and financial abilities with aging parents and family members are essential. These discussions should be part of the estate planning process.

Legal Documents and Decision-Making Powers

Estate planning should include preparing legal documents that empower decision-making for aging parents and minor children. Powers of attorney and healthcare directives are examples of such documents.

Preparing for the Future

Long-term considerations, like home renovations for elderly care, professional services, and retirement savings, are essential in estate planning for the sandwich generation. Insurance policies and emergency funds are critical to protecting the family’s future.

Regular Review and Update of Estate Plans

The dynamic nature of the sandwich generation’s responsibilities necessitates regular reviews and updates of their estate plans. This ensures that the plans stay relevant and effective in meeting the family’s changing needs.

Conclusion

By setting clear objectives and considering the complexities of your family dynamics, you pave the way for a secure future that guarantees compassionate and organized care for your loved ones. Review these key steps: 1. Establish a will and/or trust, clearly specifying asset distribution. Make decisions with aging parents while they can still contribute. 2. Appoint guardians for your minor children. 3. Designate a guardian for yourself and your parents for personal and financial matters 4. Secure powers of attorney for financial and healthcare decisions for yourself and your parents. 5. Plan for potential long-term care needs for aging parents. 6. Review and update beneficiary designations on retirement accounts and life insurance policies regularly. 7. Hold a family discussion about your parent’s estate plan to ensure clarity and understanding. 8. Communicate your plan to your Executors, Trustees, and Guardians to prevent surprises.

A well-crafted and thoughtful process is the cornerstone for achieving peace of mind. Let us help you formulate your plan. Call us at (212) 661-3600 or use this link to book an appointment.